Insights From the Annuityverse

- All

- 2020

- 2021

- 2022

- 2023

- Media

- Podcast

- Preston Cherry

- Retirement

Where Do Annuities Fit in Your Client’s Retirement Strategy?

Decisions about annuities should be made in the context of a broader strategy that includes Social Security benefits, stock allocations and bond investments.

Custom Indexes in Annuities: Dispelling the Misconceptions

Custom indexes have a vital role to play in an annuity, but they do not guarantee the best possible outcomes in all instances.

Keeping it real: 3 action plans to help women close the retirement gap

…plan sponsors can make the difference in empowering more women to get on track to reach retirement goals.

Annuities and Institutional Best Practices: A Good Fit

Could it become a future breach if DC plans don’t at least consider them?

It May Be Time To Swap The Old Annuity For A New One, Experts Say

In the current interest rate environment…

Secure Your Financial Future: How Annuities Can Help You Thrive in Uncertain Times

In today’s inflationary environment, investors are looking…

DPL rolls out member-wide access to RISA planning tool

Wade Pfau and Alex Murguia created the RISA Profile…

yourDigitalLab Announces Inaugural Digital Growth Summit Featuring Celebrated Economist & Retirement Guru Tom Hegna

Virtual summit featuring noted economist, author and retirement expert Tom Hegna.

4 Reasons for a Retirement Hardship Withdrawal

Before you raid your 401(k) or IRA, learn the realities…

How to Fix Social Security and What to Do While We Wait

Here are four proposals to modify the Social Security program …

Ask an Advisor: I’m 65 Years Old and Going to Retire Soon. How Should I Structure My Portfolio?

Shifting from building wealth for retirement to distributing wealth during retirement…

Annuity Issuers Vie for Shelf Space as Small Distributors Are Rolled Up

Annuity issuers are operating in an increasingly concentrated marketplace…

How Much Should You Have in Retirement Savings at 65?

At age 65, you may be retired or preparing to retire soon…

What Gen X Women Need To Know To Get Ready for Retirement

Gen X women are now between the ages of 43 and 58, which means retirement is on the not-too-distant horizon for some of them.

Jamie Hopkins: SVB Collapse Is Wake-Up Call on Cash Managemen

According to Jamie Hopkins, managing partner at Carson Group, these rapidly unfolding and interrelated events have underscored a few foundational financial planning concepts…

Are I Bonds a Good Investment for Retirees?

“In a high inflationary period – like today – investment and economic risk are very real for retirees,” says Paul Tyler, chief marketing officer at Nassau Financial Group. “The tradeoff is that the rate is…

Retirement Income Adoption…It Ain’t That Hard

Last December, Nevin Adams wrote a thought-provoking article titled “6 Obstacles to Retirement Income Adoption.” Nevin makes several interesting points, but in our view the…

Rising Rates Push Sales of Individual Deferred Annuities Higher: Wink

Sheryl Moore, Wink’s CEO, said MYGA contracts in particular benefited both from increases in crediting rates and consumers’ fear of market volatility. “Eighteen percent…

Kiplinger’s Retirement Report | Volume 30 | Number 3

About a dozen years ago, a video of two silver-haired seniors fruitlessly trying to figure out Skype—not knowing their webcam was on—made the internet rounds. The…

Why Clients Shouldn’t Claim Social Security Early to Protect Portfolios

Pfau is a professor of retirement income and director of the Retirement Income Certified Professional program at The American College of Financial Services.

New Retirement Law Paves Way for Insurers to Tap Your 401(k)

Wealth management is a higher-margin business than that of planned advisory services, causing the two industries to converge, said Michelle Richter of Fiduciary Insurance Services LLC,

The Growth of Integrity

The Big Three’s relentless growth is altering the distribution landscape, said Sheryl Moore, president and CEO of Moore Market Intelligence and Wink Inc.

Save Launches ESG Investing Product

“Consumers are increasingly turning to ethical choices in all aspects of life including investments,” Save Founder and CEO Michael Nelskyla said in the release.

Year in Review – 2022

In 2022, That Annuity Show had 40+ guests and 20,000+ downloads from 60 different countries. Thank you to our sponsor, The Index Standard!

Finding Peace of Mind With Your Retirement Income

Even in tough times, you can secure retirement income that lets you maintain your lifestyle, lasts a lifetime, adjusts for life events and leaves a legacy for the kids.

‘Quick fix’ concept for IUL illustrations advanced, with some dissent

A state insurance regulator subgroup came up with a “quick fix” Wednesday to address faulty illustration problems within the Actuarial Guideline 49-A.

Jamie Hopkins: Why Debt Is ‘Powerful,’ Annuities Are ‘Underutilized’

In our conversation, he explores a number of financial planning concepts, including the use of debt as a powerful tool. He also talks about why he thinks annuities are oversold…

Foldes Financial Announces Tax-Free Retirement

Foldes Financial has continued to expand its offerings across the nation, in line with the goal of Peter Foldes. Foldes Financial is hosting a free masterclass with world-renowned…

Ten to Watch in 2023: Dr. Preston Cherry

Foldes Financial has continued to expand its offerings across…

Retire Inspired

Experts from Athene and The Index Standard speak with retirement income expert Mary Beth Franklin at smart ways to plan around inflation.

7 Things To Know About Social Security and Retirement for 2022

“The death of Social Security has been greatly exaggerated,” said Paul Tyler of Nassau Financial Group in Hartford, Connecticut.

Retirement Planning: One Size Doesn’t Fit All

Virtually everything can be customized to fit us individually. And that includes a retirement income plan.

Most Americans Plan To Rely Heavily on Social Security for Retirement — Here’s What To Know

The majority of Americans don’t have much faith in the future of Social Security.

7 Money Moves Retirees Almost Never Regret

Take the time to plan when you’ll collect Social Security.

Higher Rates Fuel Q2 Multi-Year Guaranteed Annuity Sales: Wink

Higher interest rates and client concerns about stock market volatility pushed sales of MYGAs up hard in the second quarter.

Financial Literacy Is Not A Passing Grade On A Finance Exam Or Having A Large Bank Account

Paul Tyler, Nassau’s CMO, drives the branding of insurance companies and affiliated asset management companies.

Want Reliable Retirement Income? Use This Safer Strategy

One of the biggest fears you probably have about retirement is whether your money will last as long as you do.

Forbes: Sequence of returns risk is ‘upending’ retirement

A new column published by Forbes details that sequence of returns risk is harming retirees, a risk previously described as avoidable with a reverse mortgage

How To Save for Retirement as a Single-Income Earner

Planning for retirement is challenging for everyone, but it can be especially difficult for single individuals.

The Retirement Safe Withdrawal Rate Explained

A safe withdrawal rate can help prevent you from running out of funds in retirement.

Product experts: Regulators need to end ‘gamesmanship’ of IUL illustrations

Roughly 18 months after new regulations meant to tighten up indexed universal life illustrations took effect, insurers are using “gamesmanship” to make a mockery of new rules, say two leading insurance product experts.

Next Stop: Multi-Account UMAs

We know there are multiple levers to push and pull to achieve tax alpha and better financial results. Tax harvesting is only one of them.

Ask An Advisor: Where Should I Stash Short-Term Savings?

When it comes to determining where to house your short-term savings, factors to consider include risk, access, goals…

7 Things To Know About Social Security and Retirement for 2022

“The death of Social Security has been greatly exaggerated,” said Paul Tyler of Nassau Financial Group in Hartford, Connecticut.

Insurance Agents Are Unknowingly Breaking DOL Rules, Attorney Says

A number of insurance agents may be violating U.S. Department of Labor rules by accepting “conflicted compensation” from annuities sales…

Using a Holistic Approach to Retirement Planning by Taking Risk off the Table

Welcome to episode #39 of Social Security: Answers from The Experts with Martha Shedden: Using a Holistic Approach to Retirement Planning by Taking Risk off the Table with Paul Tyler

As inflation hits 40-year high of 8.6%, experts look ahead

The US said Friday the Consumer Price Index, the measure of the average change over time in prices paid by urban consumers for a market basket of goods and services, rose to 8.6%, a level not seen since Ronald Regan was president and Michael Jackson was singing “Billie Jean.”

Social Security and Retirement: 7 Things Everyone Should Know

Even if you do have retirement savings, you’ll want to be strategic about taking your benefits in a way that’s optimal for you.

Rising rates are good news for near-retirees seeking longevity insurance

Annuities are getting more attractive, so is it time to inch in as rates rise further?

The Tragic Politicization of Annuities

The Tragic Politicization of AnnuitiesAnd how to move past it to help your clients. By David Macchia

Indexes must evolve with inflation, rising rates, says NAFA panel

Many popular indexes supporting annuities and life insurance today might not work as well in a recessionary, high-inflation, and rising interest rate environment.

3 Ways Alternatives Can Help Advisors Manage Investor Emotions

Alternatives can support clients in staying the course and offer them protection in bad times. Learn more in this article by ThinkAdvisor.

High inflation means the end of the “4% rule” for retirees

High inflation means that it’s time to reassess how much you withdraw from your pension each year if you don’t want to run out of money

4 retirement income strategies to match any client’s style

When it comes to planning for retirement income, clients face a number of risks.

What Is the Social Security Administration?

Read this article to learn about how this federal agency’s programs help to support retirees.

Nearly a quarter of Americans are putting off retirement because of inflation, survey finds

Inflation is far from over, but experts say there are smart ways to address the situation.

Are You Selling a Verb or a Noun?

Meet a woman driven to change investment regulation and understand why it’s important that she succeeds.

Annuities Provide Nourishment In An Income-Starved Environment

Just as food sustains the body throughout its lifetime, an annuity sustains a client’s savings throughout their retirement.

Conference Speaker Offers New Way To View Retirement Assets

Moshe Milevsky thinks underwriters, risk analysts, and actuaries are seriously overlooking major elements of their business that could produce savings as well as make more money.

Don’t Move to Another State Just to Reduce Your Taxes

If you’re retired or near retirement, maybe a smarter plan for retirement income will allow you to stay put. Yes, your state income tax rate may be higher, but your spendable income will be, too.

Looking to Curb Your Retirement Savings? That’s a Bad Idea

Americans are chopping away at spending. That’s okay — just don’t cut retirement savings, too.

Why Advisors Shouldn’t Dismiss Index-Linked Annuities

Sales of protection-focused annuity products were higher in the fourth quarter of 2021 than the combined total of accumulation…

Reverse Mortgages and Estate Planning

A reverse mortgage could allow you to supplement your retirement income without drawing down other assets in your estate.

Retirement Planning Is No Laughing Matter: WealthConductor CEO

Approaching the challenge of retirement income planning in a lighthearted fashion may have friendliness written all over it…

RIAs Sell Verbs. Agents and Brokers Sell Nouns

If time flies when you’re having fun, then it stands to reason that the opposite is also true.

The Institute of Financial Wellness Introduces Advisory Board of Nationally Noted Thought Leaders

The Institute of Financial Wellness Introduces Advisory Board of Nationally Noted Thought Leaders

401k Education Without Walls And Beyond Boundaries

Finance is hard. It’s harder if you’ve never learned about it.

Listening To The Best And The Brightest by Jack Sharry

I built my career on listening. I especially enjoy good storytellers. With the pandemic making conversations harder to have…

TIPS and Annuities Good Bets When Inflation Is High with Wade Pfau

Higher inflation means advisors need to be more efficient in positioning client assets for retirement, says Wade Pfau…

Retirement Plan Participants Need Help With Retirement Income

From in-plan to out-of-plan, guaranteed or not, retirement plan sponsors have many options and many decisions to make.

The Two Biggest Risks for Investors and Retirement Savers

There’s no shortage of risk in saving for and living in retirement, but at the moment, market risk and sequence-of-returns risk loom large.

6 High-Return, Low-Risk Investments for Retirees

These investments can help retirees avoid extra risk while seeking better returns. As Seen in US News & Worl Report.

How Claiming Social Security Early Will Affect Spousal Benefits

“Generally, if anyone is in good health and can pay monthly bills, deferring Social Security as long as possible makes the most financial sense,” said Paul Tyler.

The Most Important Financial Goal in Retirement Isn’t What You Think

Even more important than not running out of money in retirement is another goal: not having to make crucial financial decisions as you age.

The Good, The Bad, And The Ugly On Annuities In 401k Plans

You may love annuities. You may hate annuities. You may merely say “Meh” about annuities.

The Intuition for Reverse Mortgages

Excerpted from chapter 1 of Wade Pfau’s newly revised book, Reverse Mortgages…

Regulators Wary Of Disruptions To Hot RILA Market With New Rules

Concerns over how much disruption to intro to the thriving market for indexed-linked variable annuity products…

Annuity Payments Don’t Make Your Retirement: They Make It Better

Why do annuity payments belong in a plan for retirement income?

Retirees, Here’s What to Consider When Buying an Annuity

Annuities are sometimes touted as a solution for retirees concerned about outliving their savings…

New Film Focuses On Boomers’ Retirement Struggle

The movie addresses many of the struggles Baby Boomers will face in the next 10-20 years.

Kitces Report: The Technology That Independent Financial Advisors Actually Use (And Like)

Click this link to learn more about The Technology That Independent …

New Legislation Would Allow Lifetime Income Products As Default Retirement Plan Investment

Bipartisan legislation to eliminate a barrier preventing lifetime income products as default …

5 Simple Habits That Will Help You Save for Retirement

Saving for retirement can be a struggle. You might have many years left in your career, and it can seem almost impossible to save the necessary hundreds of thousands or even a million dollars.

PG-Rated Film on Annuities Hits the Big Screen. Well, Kind of.

Retirement income and annuities are getting the Hollywood treatment

New Episode of Psych & Stuff: ‘Money on Your Mind? Financial Psychology with Prof. Preston Cherry’

This episode covers the importance of financial literacy…

Is Your Client A ‘Decumulator’ Or A ‘Retirement Incomer’?

There’s a big difference between retirement income and decumulation…

Retirement Expert Wade Pfau Discusses Dividend Stocks, Long-Term Care, and More

Economist Wade Pfau’s views on funding retirement…

Retirement Strategy: 6 Useful Tips To Live Off of Interest Alone in Your Golden Years

These strategies will put you on the right path…

For Annuity Issuers, ‘Direct to Consumer’ Is Still Mostly a Dream

When mutual funds started selling products online more…

A New Matrix for Personalizing Retirement Income Strategies

A new study identifies a set of scorable retirement income factors…

A lasting stock market downturn can be a big problem early in your retirement

The world’s first high yield credit card…

Introducing the Save® Wealth card, the world’s first high yield credit card that provides market returns instead of points or cash back

The world’s first high yield credit card…

WealthManagement’s Fifteen Must-Listen Financial Podcasts Featuring That Annuity Show

The cast of That Annuity show is proud to…

Advisors Ponder Bitcoin, ‘Decade Of Disappointments’ In 2021 News

There’s still money to be made off Bitcoin purchased…

Factoring Inflation into Your Retirement Plan

Right now, inflation is top of mind for everyone, perhaps especially retirees.

7 Easy Ways Every Boomer Can Catch Up on Retirement Savings

A key principle in saving money is making sure you don’t owe anything.

AM Best Upgrades Credit Ratings of Nassau Financial Group, L.P.’s Insurance Subsidiaries

AM Best has upgraded Financial Strength Rating to B++

In a $1 Million Retirement Income Portfolio, Investors Choose Annuities and Protection Over Traditional 60/40 Allocation

A significant majority of investors…

Opinion: Why small amounts saved now can boost retirement income later in life

Opinion article by Michelle Richter and Bob Melia – One way to help retirees stretch their savings further…

Evaluating an early retirement offer: What to consider before accepting one

“You may be lucky enough to have earned and saved enough to be financially independent. If you fall into this rare category…

Annuities And Predicting The Right Time For The Market With Paul Tyler

Paul Tyler joins Kevin McCullough to talk annuities and market predictions in this ep of Radio Night Live!

Wink, Inc. Names New President

Victoria L. Grossman has been named the President of Wink, Inc. Sheryl J. Moore will continue in her role as Chairwoman & CEO.

What’s Your Retirement Number? Don’t Just Go by the 4% Rule

To help make sure your retirement income covers your needs and lasts for a lifetime, you need a custom plan. The 4% rule of thumb is a starting point…

Swap Your 401(k) and start receiving a Lifelong Monthly Check

“Therefore, it’s excellent to view they presently are frequently having annuity rights or different sorts of plans to achieve a retirement plan.”

Fi360 Announces Formation of ‘Lifetime Income Consortium’

Broadridge Fi360 Solutions & Fiduciary Insurance Services have teamed to initiate a Lifetime Income consortium to promote the need for guaranteed income options within retirement plans.

Annuities Genius Partners with CANNEX to Leverage Data for New SPIA/DIA Tools

Annuities Genius has partnered with CANNEX to use its data for their new SPIA and DIA comparison tools.

5 Ways to Get Your Firm Unstuck

These activities might help get your firm out of its rut, but it’s up to you to make it happen.

Six Retirement Planning Lessons From Netflix’s ‘Squid Game’

How to make sure your clients avoid playing games with their retirement funds.

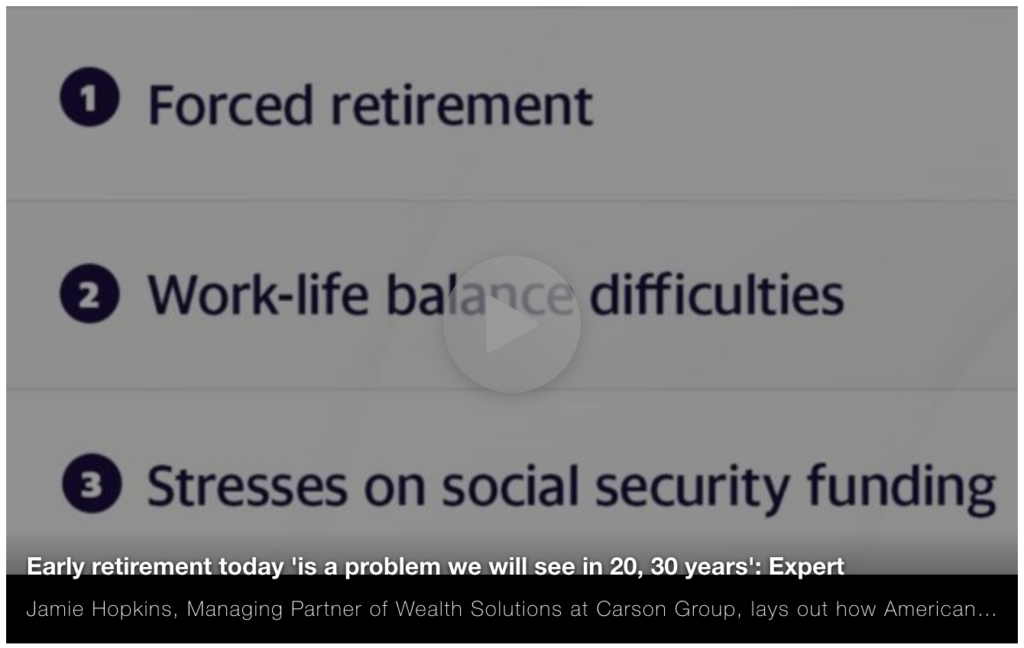

Early retirement today ‘is a problem we will see in 20, 30 years’: Expert

Jamie Hopkins lays out how Americans should be planning and saving for retirement, anticipating unexpected market impacts, and more.

8 Best Investing Podcasts Investors Should Know About

Investors shouldn’t miss out on these eight great investing podcasts. Podcasts are taking over.

Sales May Be Down, But The Annuity Industry Will Bounce Back

Investors shouldn’t miss out on these eight great investing podcasts. Podcasts are taking over.

That Annuity Show

That Annuity Show

Google

Google

Recent Comments