I try to avoid political debates in my writing, but sometimes it’s unavoidable. Discussing Social Security and how to maintain its solvency is clearly a highly charged subject. It’s also timely, and I propose a new way to think about Social Security and how to leverage its administrative and actuarial support infrastructure.

My criteria for program changes are quite simple: (1) Social Security should be fair to all beneficiaries without the ability for anyone to “game” the system, and (2) Social Security’s ability to deliver lifetime cost-of-living protected income should be leveraged and made available in the private marketplace.

Why Should Anyone Listen to Me?

Well, I am trained as an actuary, one of those people who understands longevity and investment risk in the case of retirement and then uses that understanding to determine, for example, what consumers should pay for insurance, or for lifetime income. It’s more interesting than it sounds. My aha! moment came early in my career, when I was introduced to payout annuities and realized they offer an elegant, and fairly priced, solution to the risk of a retiree living longer than their bank accounts.

Why We’re a Little Worried

To put the Social Security financial challenge in perspective, by 2050, people age 65 and older will comprise 22% of the U.S. population, according to the Census Bureau(opens in new tab). The total was about 14% in 2012. That doesn’t sound like a lot, but it represents more than a 50% increase in the prime benefit-receiving population.

The Social Security Trust Fund releases a report each year that estimates when the fund’s reserves will be depleted and benefits — without intervention — would have to be reduced. The latest report(opens in new tab) predicts that the cuts to 77% of expected benefits would come in 2033.

The Office of the Chief Actuary of the Social Security Administration(opens in new tab) prepares an exhaustive analysis of multiple ways to adjust benefits, retirement age, payroll taxes, etc., to make sure we don’t fall off that cliff. With apologies to the diligent actuaries in that office, I would also propose some changes in how we view the purpose of Social Security. Perhaps some combination of those financial adjustments and my program changes just might work.

Specific Proposals for Change

I am talking about modernizing Social Security and not privatizing it. In fact, I’m suggesting we expand it in new ways. Here goes:

- Permit deferral of Social Security benefits beyond age 70. The later that people start benefits, the more money they would get each month. Deferring payments would reduce the outflow of cash from the system and would buy time for younger earners to enter the job market and start paying their share of taxes.

- Permit a gradual move into Social Security benefits. As people live longer, more of them prefer to cut back on their work, but not stop working completely. Let them do it so they can receive a portion of their Social Security benefits necessary to complement earned income. Payouts would increase in the long run, but cash flow would be lower in the short run.

- Allow buy-in to the Social Security system from 401(k) or rollover individual retirement account (IRA) savings. This would supply new cash for the system and, in return, provide an additional source of inflation-adjusted lifetime income. Rather than competing with the commercial annuity market (which is relatively small compared to Social Security), this would be a new market, earning a positive return for the Social Security system.

- Finally, the reform would gradually increase normal retirement age to reflect Americans’ increased longevity and slowly push back the date of retirement for full benefits. Basically, like any annuity payout, it has to be priced to the market.

While I don’t have the models that the actuaries at the Social Security Administration use, these proposals would increase the net cash flow into the system. As important, it might take the discussion back from a political dogfight.

What Should You Do Now With Social Security as Part of Your Plan?

Here’s a stepwise approach to designing a plan for retirement income and bringing in Social Security benefits at the right time.

First, look at how much income your retirement savings can generate. As I indicated in my article Doing Your Retirement Planning in the Right Order Matters, it’s important to tackle the design of your plan in logical steps. Get comfortable with the plan’s assumptions, the percent of safe income and the ability to respond in real time to market volatility and life issues.

Second, look at your Social Security claiming options. It’s relatively easy to determine at MySocialSecurity.gov(opens in new tab) what you will earn at 70 vs. claiming earlier. While our actuarial analysis shows the fair tradeoff between claiming options, you may have personal considerations, like budget needs or your health, that change the calculation. This article on Four Ways Claiming Social Security Early Can Be Smart lists some of the questions to ask if you think you might benefit from claiming early. The article Why Wait Until 70 to Take Social Security Benefits? discusses the benefits of waiting as long as possible.

Third, create a plan that combines your income from savings with your Social Security benefits. Compare your budget and adjust the claiming date, or the need to withdraw savings to make up any shortfall. We call this your strategic plan.

Fourth, in virtually all cases, you need help from a financial adviser who can look at tax strategies like Roth conversions, insurance strategies like long-term care and implementation options in transition to the new plan.

An Integrated Go2Income Plan with Social Security

Let me give you an example for a plan that we just developed for an individual who visited our Go2Income(opens in new tab) planning website.

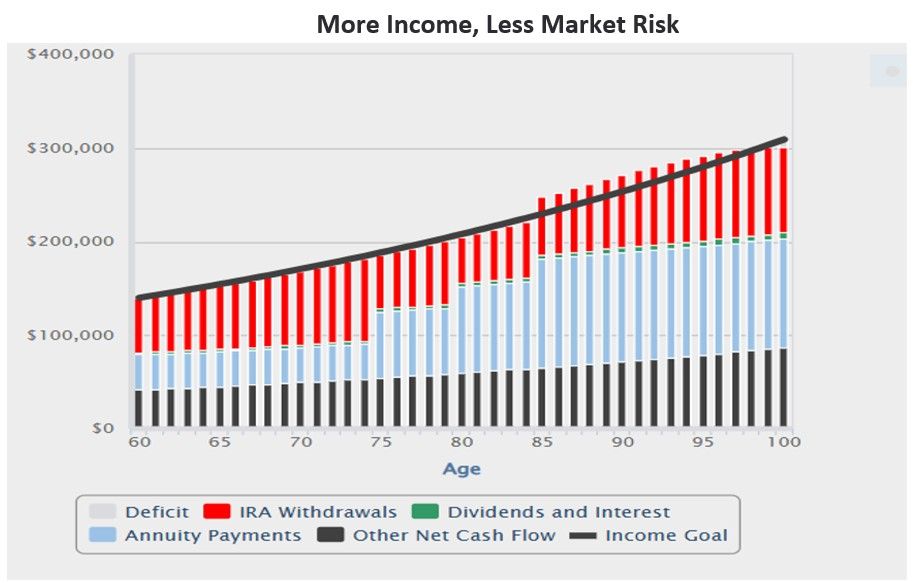

As you can see from the graph below, the investor age 60 is retiring before she can claim Social Security, and so we deducted the first two years from her retirement savings.

This plan worked out almost perfectly, which out of the (literally) zillions of possibilities is pretty amazing.

What Happens to Our Investor if No Agreement Between the Parties?

To wrap up this clear-eyed discussion of how to save Social Security and design your plan today, let’s consider what would happen if no one listens, and in the early 2030s, benefits are cut by nearly 25%. In our example above, the retiree would see her $2,800 per month Social Security benefit cut by $700 per month in 2034. (This assumes everyone’s benefit is cut by 25% all at the same time.) Well, how would our retiree fare? If she wanted to be very conservative and overfunded her income annuity purchases by around $50,000, she’d cover her lost income or have bonus income.

In this scenario, the legacy to her heirs may be lower than originally planned, and the initial payment she makes to purchase the annuity will, at the beginning, reduce her available cash. Overall, though, she will still be in good shape.

I’m not proposing this, just planning for the contingency. Must be the actuary within me.

I’ve given you a lot of information to consider. But at Go2Income, you can research all the different aspects that will make up the best plan for you and your family. You can also receive a no-obligation plan(opens in new tab) that will show you how to make your own retirement the best it can be.

Receive Updates

Show Sponsors

The discussion is not meant to provide any legal, tax, or investment advice with respect to the purchase of an insurance product. A comprehensive evaluation of a consumer’s needs and financial situation should always occur in order to help determine if an insurance product may be appropriate for each unique situation.

That Annuity Show

That Annuity Show

Recent Comments